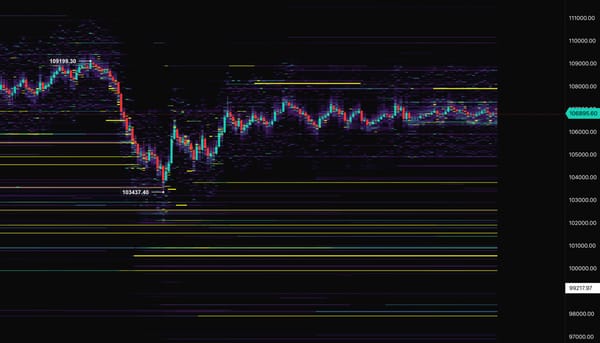

Trading Secrets Of The Inner Circle

An Experiment To Help You Learn Trading

Greetings folks,

I have about 250 Trading PDF books about everything from Forex Trading, Technical Analysis, Indicators, you name it and nobody has the time to read through all of these tens of thousands of pages. So, I’m trying something new that may help you all. Below I’m going to post content related to one of these Ebooks as well as an AI discussion about the book. Then, I’m going to post a poll to find out if you found the content helpful. Did you learn something? Was it valuable? If you all like it, I’m going to focus on releasing one of them a week for each book. So, lets see how it goes.

Crows Nest Newsletter is a reader-supported publication. More Posts like this will be published to members only from now on. Make sure you join and continue learning!

FAQ: Stock Market Timing and Trading Strategies

Timing the Market

Q1: How can I use market breadth indicators to improve the effectiveness of RSI in trading the S&P 500?

A1: Market breadth indicators can provide valuable insights into the overall market trend, supplementing oscillator-based strategies like the RSI. Here's how to incorporate a 10-day market breadth filter with the 8-day RSI for trading S&P 500 futures:

- Calculate the 10-day simple moving average (SMA) of advancing and declining issues on the NYSE. This data is widely available through financial news sources and trading platforms.

- Divide the 10-day SMA of advancing issues by the 10-day SMA of declining issues. This ratio reflects the market's internal strength.

- Interpret the ratio:

- A ratio above 0.75 suggests a positive breadth filter, indicating underlying market strength.

- A ratio below 0.50 signals a negative breadth filter, pointing to potential weakness.

- Combine with the 8-day RSI:

- Long Entry: Buy the S&P 500 futures on the close when the 8-day RSI crosses above 30, but only if the market breadth filter is positive.

- Exit Long: Sell your position if either:

- The 8-day RSI crosses below 65.

- The market breadth filter turns negative, even if the RSI hasn't reached the exit signal.

This strategy helps avoid long positions when the broader market shows weakness, even if the RSI suggests an oversold condition.

Q2: Is there a way to anticipate major market crashes or corrections?

A2: While predicting market crashes with certainty is impossible, certain indicators can act as warning signs. The "Crash Filter Model" utilizes interest rates and currency movements:

- Track weekly closing prices of the 10-year Treasury note futures and the U.S. Dollar Index futures (DX).

- Identify potential weakness:

- Interest Rate Filter: Bearish if the weekly close of the 10-year note is lower than its lowest close over the preceding ten weeks.

- Currency Filter: Bearish if the weekly close of the U.S. Dollar Index futures is lower than its lowest close over the preceding eight weeks.

- Activate the Crash Filter: When both the interest rate and currency filters turn bearish simultaneously, it suggests a heightened risk of a market correction over the following 20 trading days.

Important Note: This model serves as a cautionary indicator, not a guaranteed prediction. False signals can occur. It's crucial to combine this with other analysis methods and risk management strategies.

Options Trading and Volatility

Q3: How can I utilize the VIX Index to improve my options trading?

A3: The VIX Index, reflecting implied volatility in S&P 500 options, can be a valuable tool for options traders. While you can't trade the VIX directly, use its signals to time your options entries and exits:

- Sell Volatility (Sell Options): When the VIX rises 2 points above its 40-day moving average, consider selling options as implied volatility (and option premiums) are high and potentially ready to decline.

- Buy Volatility (Buy Options): When the VIX falls 2 points below its 40-day moving average, consider buying options as implied volatility is low and potentially ready to rise.

- Manage Positions: Exit your VIX-based options trades using the following guidelines:

- Shorts: Exit when the VIX falls 2 points below your entry and is within 2 points above its 40-day moving average.

- Longs: Exit when the VIX rises 2 points above your entry and is above its 40-day moving average minus 2 points.

Remember, this strategy aims to capitalize on the tendency of implied volatility to revert to its mean. It's not about predicting market direction, but rather timing entry and exit points based on volatility levels.

Q4: Is there a way to profit from the increased market activity around options expiration dates?

A4: Options expiration dates often bring heightened volatility and trading volume. One strategy is to identify unusual volatility patterns several days before expiration:

- Calculate the daily range of the S&P 500 five trading days before options expiration.

- Compare the range to the average range over the previous three days. An unusual volatility disturbance occurs when the range is:

- Less than 70% of the average range (signaling unusually low volatility)

- Greater than 140% of the average range (signaling unusually high volatility)

- Trade the Pattern:

- If an unusual volatility disturbance is detected, buy the S&P 500 futures on the close of that day.

- Hold the position until the close of the options expiration day.

This strategy capitalizes on the potential for price movements leading up to and on expiration day.

Day Trading the S&P 500

Q5: What is the 'Countertrend Tuesday Effect,' and how can I trade it?

A5: The "Countertrend Tuesday Effect" observes a tendency for the market (specifically the S&P 500) to reverse the trend established on Monday. Here's a pattern to watch for:

- Observe Monday's close: Look for a down day with a larger range than the previous three days. The closing price should be higher than the highest close of the preceding four days.

- Trade the Reversal: If Monday fits the pattern, sell short the S&P 500 at Tuesday's open, anticipating a decline.

- Exit: Cover your short position at Wednesday's open, aiming to profit from the potential Tuesday reversal.

Exploiting Market Psychology

Q6: What is the "Friday/Monday Effect," and how can I use it to my advantage?

A6: The "Friday/Monday Effect" encompasses several patterns related to the beginning and end of the trading week. Here are two strategies:

Strategy 1: Fading Friday Declines

- Observe Friday's close: Look for a significant drop in the S&P 500, closing below the lowest price of the preceding ten days.

- Trade the Potential Reversal: Place a buy stop order just before Monday's open at the highest closing price of the previous three days.

- Manage the Trade:

- If the market doesn't hit your stop, cancel it at the close of Monday.

- If the pattern repeats (another close below the lowest low of the preceding six days), place a new buy stop order before Tuesday's open at the then-current highest close of the preceding three days.

Strategy 2: Monday Range Contractions

- Observe Thursday's and Friday's close: Look for two consecutive up days in the S&P 500. Friday's range should contract, closing within 75% of Thursday's range.

- Trade the Potential Continuation: If the market opens higher on Monday, buy at the open, anticipating further upside momentum.

Q7: How can I take advantage of short-term reversals in the S&P 500?

A7: The S&P 500 often exhibits short-term swings between relative highs and lows. A simple reversal system can help capitalize on these moves:

Buying Reversals:

- Identify the Setup: The S&P 500 closes below its lowest price over the preceding six days.

- Place Your Order: Just before the next day's open, place a buy stop order at the highest close of the preceding three days.

- Manage the Trade:

- Cancel the stop order at the close if not triggered.

- If the setup repeats (another close below the six-day low), place a new buy stop order before the following day's open at the then-current highest close of the preceding three days.

Selling Reversals (Shorting):

- Identify the Setup: The S&P 500 closes above its highest price over the preceding six days.

- Place Your Order: At the next day's open, place a sell stop order at the lowest close of the preceding three days.

- Manage the Trade:

- Cancel the stop order at the close if not triggered.

- If the setup repeats (another close above the six-day high), move the sell stop order to the then-current lowest close of the preceding three days.

- If the stop is triggered, hold the short position for five days, exiting on the close of the fifth day.

Finding Winning Stocks

Q8: How can I identify potentially powerful stocks before Wall Street analysts catch on?

A8: Outmaneuvering Wall Street often involves spotting opportunities before they become widely recognized. The "Value Line Outflanking Maneuver" helps you do just that:

- Subscribe to the Value Line Investment Survey: Focus on stocks ranked 2 or 3 (out of 5) in their rating system.

- Monitor Earnings Reports: Track the companies you've identified for positive earnings surprises—when reported earnings exceed analysts' consensus estimates.

- Take Action: Buy shares of companies with Value Line rankings of 2 or 3 that announce positive earnings surprises. The surprise often triggers upward revisions in analyst estimates and potential buying pressure, giving you an early entry point.

This strategy capitalizes on the lag between a company exceeding expectations and the broader market fully recognizing its improved outlook.